Vision

Granite Peak Equity sources stabilized, value-add apartment properties of 50+ units in size, located in stable sub-markets which are poised for growth. These properties are then aggressively repositioned to effect:

- Revenue maximization through targeted capital improvement

- Cost containment through the implementation of institutional asset & property management

Granite Peak Equity strategically targets exit from dramatically appreciated assets timed to coincide with an optimal position in the local market cycle. Participation window averages five to seven years.

Acquisition Criteria

Property Type: Garden Style and Mid-Rise Apartments

Asset Class: A+ to C+

Location Quality: A+ to C+

Property Size: 50+ units; single asset or portfolios

Pricing: $1M to $20M+

Property Vintage: 1978+

Acquisition Structure:

- All cash to seller

- Loan assumption on a case-by-case basis

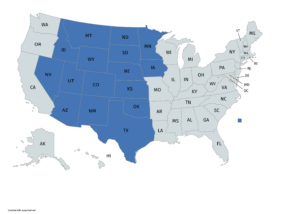

Target Markets

Throughout the western United States with an emphasis on the below states: